|

Powered by AltAlpha AI

|

Authored by Divyank Dewan, 4th year student of law at National Law Institute University, Bhopal

Recently, the Indian Government has underscored the urgent need to fortify the related party clause, under the Companies Act, 2013 due to numerous breaches. The root of the issue, lies in the current regime’s reliance on disclosure and its lenient enforcement. This blog delves into how the existing legislative loopholes are undermining regulatory efforts, despite SEBI’s stringent measures to ensure accountability and its vigilant role as the watchdog of the Indian market.

Introduction

Related party transactions (“RPTs”) involve business dealings between a company and its related parties, such as directors, key managers, subsidiaries, and their families or entities they control. These transactions are ripe for fraud, so maintaining fairness and accountability is crucial. While some RPTs are economically beneficial and necessary owing to a more reasonable price, but on the other hand they may enable dominant shareholders to exploit minority investors. Despite existing safeguards, the misuse of RPTs in this sense has led to significant corporate fraud, undermining the core principles of corporate governance.

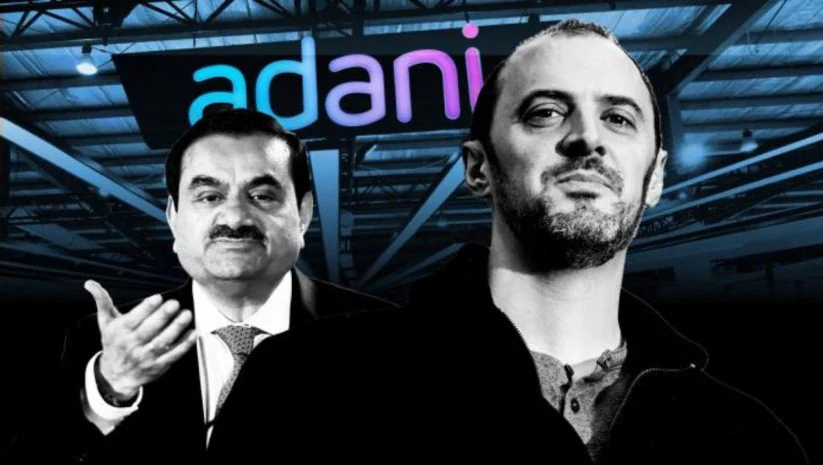

This article delves into the primary legislations governing RPTs and bringing forth the contemporary controversy between Adani and Hindenburg wherein undisclosed RPTs were discovered. The article in its second part underscores the need for stronger regulatory measures.

Legal Framework Governing RPTs

There are two key provisions governing RPTs which have been brought forth hereinafter namely Companies Act, 2013 (A) and the SEBI LODR Regulations (B).

Companies Act 2013 (“Act”)

The concepts of relative and related party are crucial in the context of related party transactions as per the Act. A relative includes members of a Hindu Undivided Family, a spouse, and other close relatives, as specified in Rule 4 of the Companies (Specifications of Definitions Details) Rules. A relative is determined with reference to an individual, while a related party is identified with reference to the company. The Act expanded the definition of a related party to include key managerial personnel, persons acting on directions of a relative, and associate firms. It mandates approval by shareholders and the audit committee, along with specific disclosure requirements under Form MBP-4 as laid down in Rules 15 and 16 of the Companies ( Meeting of Board and its Powers) Rule 2014 and the company’s board report as under section 134(3)(h) and 188(2) of the Act and Rule 8(2) of the Companies (Accounts) Rules 2014.

However, exemptions exist for RPTs under the Act. Transactions conducted in the company’s ordinary course of business on an arm’s length basis, and those arising from compromises, arrangements, and amalgamations, are exempt from these provisions and do not require shareholder approval. Also, if the company enters into a transaction with a related party who is also a member, that member is not allowed to vote on the RPT in the general meeting held for this purpose.[1]

SEBI Listing Obligations and Disclosures Requirements Regulations 2015

The SEBI LODR Regulations, 2015 (“LODR”) which applies to all listed entities defines the expression related party broadly as

“any person or entity belonging to the promoter or promoter group of the listed entity and holding 20% or more of shareholding in the listed entity.”

This definition was added as per the recommendations of the Kotak Committee in 2018.

The regulation stipulates that transactions exceeding 10% of the listed entity’s annual consolidated turnover, based on the most recent audited financial statement, and 5% for related party payments related to brand usage or royalty payments, are considered material. All such material RPTs require shareholder approval through an ordinary resolution.

Regulation 23(4) disallows voting rights for all members who are related parties of the listed entity, regardless of whether a particular related party is involved in the transaction placed before shareholders for approval at a general meeting.

Additionally, the Indian Accounting Standard 24 (“Ind AS-24”) governs disclosures pertaining to related parties. Both consolidated and standalone financial statements must disclose related party relationships. Ind AS-24 requires a parent and a subsidiary to disclose their relationships, even if no transactions have occurred between them.[2]

The Involvement of RPTs in the Adani-Hindenburg Saga

In January 2023, US-based short seller Hindenburg Research published a report alleging malpractices by the Adani Group. That included cooking books of accounts, over-invoicing of import costs and round-tripping of own money to push up share prices. There were 13 allegations and a major part of SEBI’s investigations was the alleged failure to disclose RPTs on the part of the Adani group and thus manipulation of stock prices.

SEBI has taken severe cognizance and went to the extent of issuing 90 summons for the personal appearance of Adani group officials and recorded 70 statements while examining approximately 33,550 pages of documents related to these transactions. This shows that SEBI has taken all relevant steps on its part in terms of investigation, even recently the Adani group received show cause notices from the SEBI alleging non-compliance of provisions of the listing agreement and LODR regulations pertaining to RPTs in respect of certain transactions with third parties.

This makes it apparent that SEBI has made all possible attempts to keep RPTs in check, there is only so much they can do and there lie some issues with the legislations itself and the exceptions provided in it which lead to their widespread misuse.

Challenges and Loopholes in Regulating RPTs

RPTs have multiple loopholes prevalent in them owing to which they take place in a way such that they have an unfavourable effect. There exist some loopholes in the regulatory framework itself owing to which there is a misusage of the leverage provided since it is mainly a disclosure-based framework. One of the loopholes in the regulatory framework is that the exception laid down in the Act regarding companies in the ordinary course of business need not attain shareholder approval. The term ordinary course of business has not been defined adequately and thus it may interpreted in a sense such that all transactions can be deemed to be in ordinary course of business by framing the policy in such a way.

The LODR allows aggregated transactions up to ten percent of an entity’s annual consolidated turnover to bypass shareholder approval but is prone to abuse. The top 10 companies in India average 33000 crore in revenue annually, this threshold equates to 3300 crore—this is hundreds of times more than the annual turnover of smaller listed companies. As a result, most RPTs fall below this threshold, evading shareholder scrutiny. Additionally, the regulation’s reliance on the financial year for its application introduces further risks. By spreading RPTs from February to April, companies can exploit two financial years’ thresholds, allowing transactions nearing twenty percent of the consolidated turnover to avoid shareholder approval since disclosures are to be made only up till 31st March in each financial year. This loophole undermines transparency and accountability, necessitating urgent regulatory reform. Also, the exclusion of mergers and amalgamations from SEBI’s RPTs provisions is problematic. In India’s growing economy, these transactions are common. Their exclusion allows questionable RPTs to go unchecked, undermining transparency and accountability in corporate practices.

The Companies (Amendment) Act 2020 increased fines for RPT violations under Section 188 but removed imprisonment for directors and key personnel.[3] This weakens corporate governance, as fines may be seen as a manageable cost. Consequently, directors might bypass procedures, knowing they only face a fine, which large corporations can easily afford.

The Act prevents the related party in a transaction from voting on it in a general meeting, but their relatives, who may be shareholders, can still vote. The LODR corrects this by barring any related party from voting, but this issue persists for unlisted companies not covered by these regulations.

Conclusion

In conclusion, while SEBI has been diligent in monitoring and regulating RPTs, as shown by the probe into the Adani-Hindenburg controversy and a recent warning to Linde India to comply with materiality thresholds for future RPTs after shareholder complaints, the core issues stem from legislative inadequacies. The current framework, heavily reliant on disclosure, is susceptible to exploitation. To safeguard minority investors and uphold corporate governance principles, it is imperative to address these legislative gaps. Strengthening the laws to make them more stringent and enforceable, rather than merely disclosure-based, is crucial. Such reforms will enhance transparency and accountability, ensuring that RPTs do not undermine the integrity of the Indian market and corporate governance.

[1] As per Notification No. GSR 464(E) dated 5-6-2015, private companies are exempt with this provision with respect to RPTs, whereby, all shareholders are entitled to vote irrespective of whether any member happens to be the related party with respect to the transaction requiring shareholders’ approval.

[2] Indian Accounting Standard – 24, para. 13.